The tax season is carried out.

This year, Republicans in Congress turned the tax season into the “sales” season. Republicans and President Donald Trump pressure to agree to a draft law to re -delegate the tax reduction package for 2017. Otherwise, these taxes end later this year.

“We have absolutely to make permanent tax cuts,” said MP Tom Tiffany, R-Wis, at Fox Business.

Senator Mike Rollz, RS.D, RS.D, RS.D, RS.D, RS.D, RS.D, RS said. , RS.

Rice rates for almost every American height if Congress does not behave over the next few months.

Confidence in Democrats hit all the time in a new survey

Parliament Speaker Mike Johnson, R, speaks. , With the media after the house approved the budget decision on Thursday, April 10, 2025. (Tom Williams/CQ-Roll Call, Inc via Getty Images)

“We are trying to avoid tax increases on the most vulnerable population in our country,” said MP-Van Dueen, R-TEXAS, a member of the Roads and A means of the House of Representatives, which determines the tax policy. “I am trying to avoid stagnation.”

If Congress stumbles, the non-partisan tax institution estimates that the married couple and have two children-a $ 165,000 per year-is slapped with an additional amount of $ 2,400. The only parent who does not have children get $ 75,000 annually to see $ 1700 on their tax bill. One of the only parents is slapped with two children who bring at home 52,000 dollars per year, with an additional amount of $ 1400 a year.

“Very important. This is additional mortgage payment Daniel Bonn of the non -party tax institution or that people are used to living with the policies currently in nearly eight years to eight years so far, nearly eight years have been so far, or additional lease batches, people have become used to living with the policies that have been at the present time almost eight years ago. The shift to the policy that was before the 2017 tax cuts will be a significant tax increase for many. “

But technically, Republicans do not reduce taxes.

“Simple as much as I can do this bill,” said Senator James Lanford, R-OKLAHOMA, on Fox.

Congress had to write the 2017 tax reduction bill in some way until the validity of the discounts ended this year. It was for accounting purposes. Congress did not have to calculate the tax cuts against the deficit thanks to some difficult numbers mechanisms-as long as they expired in a multi-year window. But the result is that taxes can climb if legislators fail to renew old discounts.

“It is the sunset, so you are automatically returning to tax levels before 2017,” said Senator Chuck Grassley, R-IOWA.

A recent poll of Fox News found that 45 % of those surveyed – and 44 % of independents believe that wealthy people do not pay enough taxes.

Democrats hope to transform anger from the perceived tax contrast against Trump.

“He wants his billionaire comrades to get a larger tax break. Is this disgraceful?” Senate minority leader Chuck Schumer, DN.Y, asked in a gathering in New York.

“shame!” Someone cried in the crowd.

“Check!” Follow Shomer.

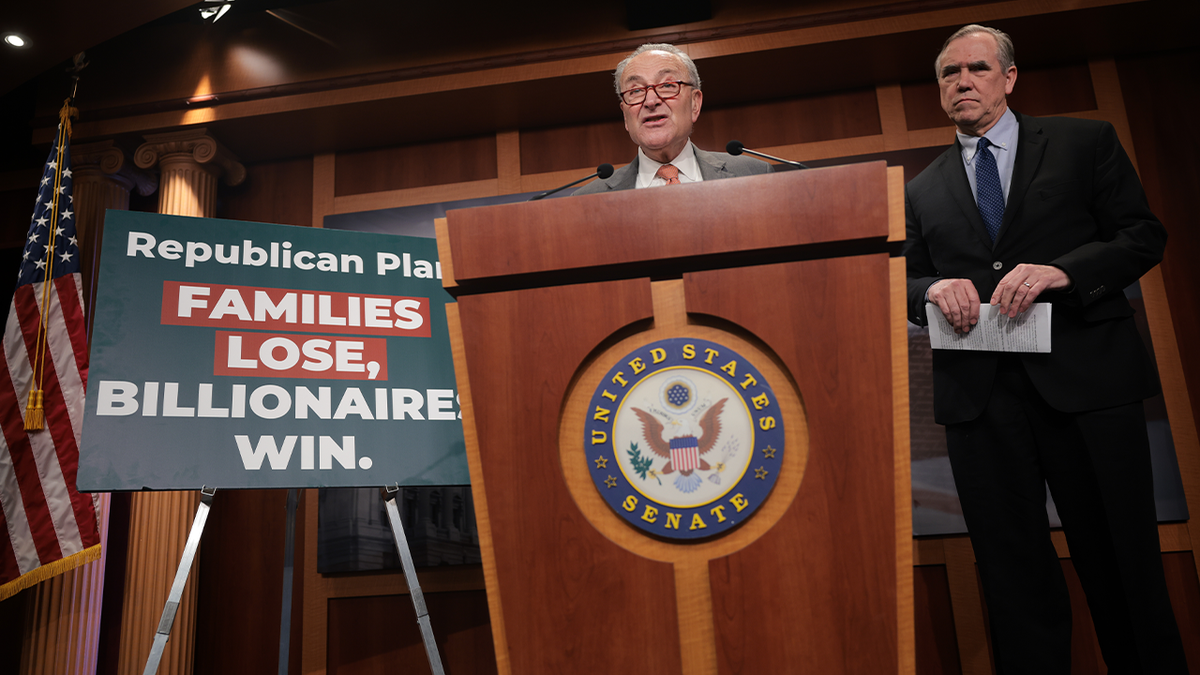

The leader of the minority in the US Senate Specific Chuck Schumer, DN.Y, (PBUH) speaks alongside Senator Jeff Merkeley, D-Ur. (L) to reporters during a press conference on the effects of the proposal of the Republican budget in the Capitol in the United States on April 10, 2025 in Washington, DC. (Kayla Bartkowski/Getty Images)

Some Republicans now explore raising rates on wealthy or companies. There was gossip in the Capitol Hill and in the administration about exploring an additional set of taxes.

“I don’t think the president made a decision on whether or not he was supporting him,” said White House spokeswoman Caroline Levit.

“We will see where the president,” said Treasury Secretary Scott Beesen while traveling in Argentina. “Everything is on the table.”

The cabinet spokesman then Bessin’s statements.

“What is outside the table is a $ 4.4 trillion tax increase on the American people,” a spokesman said. “In addition, the companies’ tax cuts will lead to a mutation in manufacturing and grow quickly the American economy.”

Republican leaders of Congress rejected the idea.

“I am not a great fan of doing this,” said Mike Johnson, Speaker of Parliament. “I mean, we are the Republican Party and we are to reduce taxes for everyone.”

The federal judge temporarily restricts Dog to the allocated social security data

“I do not support this initiative,” said Steve Scalez, the majority leader in the House of Representatives, R-La, on Fox Business, before adding “everything to the table”.

But if you are President of Donald Trump and the Republican Party, think about the policy of creating a new corporate tax rate or long -distance walking taxes.

Sunrise Light hit the American Capitol dome on Thursday, January 2, 2025, when the conference is scheduled to start 119 on Friday. (Bill Clark/CQ-Roll Call, Inc via Getty Images)

The President expanded the Republican Party base. Republicans are no longer the “wealthy” party. Handic workers, store bells, stores and small companies now include the Republican Party in Trump. So maintaining these tax cuts helps in the heart of the working layer. Raising taxes on the wealthy would help Republicans pay the price of tax cuts and reduce the strike on the deficit. Republicans will protect the Democrats argument that tax cuts are for the wealthy.

Congress is now in the mid -two -week holiday for Easter and Easter. Legionships and employees are the Republican Party behind the scenes to actually write the draft law. Nobody knows exactly what will be in the bill. Trump promised any taxes on tips for food service workers. There is also a talk about the lack of taxes on additional work.

The White House photo shows the place where the parties stand on immigration amid the deportation of Abrego Garcia

Republicans from high -tax states like New York and Pennsylvania want to see “salt” reduction. This is where taxpayers can delete “government and local taxes”. This ruling is very important to ensure the support of Republicans such as actors Nicole Malekotis, RN.Y, Mike Lawler, RN.Y. But including reducing salt also increases the deficit.

So how will the bill look like?

“The simple adjustments inside them are naturally on the table,” said Rlonds. The key though, [is] 218 in the House of Representatives and 51 in the Senate.

In other words, it relates to mathematics. Republicans need to develop the correct legislative drink that gets the correct amount of votes in both chambers to pass it. This may mean including some rulings – or throw others. It is difficult. Especially with the majority of the slim house.

People are attending a press conference and a massive gathering to support fair taxes near the American Capitol building in Washington, DC on April 10, 2025. (Pictures of Brian Duziere / Middle East / Middle East photos via AFP)

Bonn said from the 2017 draft law: “There were differentials and displacement within the draft law. Many people are not satisfied with it.” “It is not clear how the package will meet with these different differentials.”

Johnson wants the full bill on the day of the anniversary. Republicans know that this institution cannot be withdrawn until it is too late until the year. Tax drivers will witness a tax increase – even if it is temporary – if the bill is extended in the fall when the tax authority begins preparing for the next tax season.

It is also believed that the completion of this sooner and not later will provide some stability for the volatile stock markets. The set of tax policy for the next year will calm concern about the nation’s economic expectations.

“The Grand and Beautiful Bill,” it is called Trump, adding that he wants to legislate “soon.”

Click here to get the Fox News app

This is why the tax season is now the sales season. Either for legislators. And for the public.